FinTech Fund II

Launched January 2022

$1.9 Million Investor Commitments

Minimum Investment: $250,000

Fee Structure: 2/1/10 on Committed Capital

Projected Close January 2024 may be extended to December 2024 at Manager's discretion

Open to Qualified Purchasers Only

Objective

The Fund seeks to opportunistically acquire a portfolio of funds and companies that seek to invest and profit from investments in Financial Technology. Examples include software, or digital services that improve efficiency, speed, or decrease costs or overhead in the provision of financial services, including, but not limited to insuretech, regtech, roboadvisory, banktech, digital lending, cybersecurity, digital signature, identity technologies, blockchain, machine learning, AI, smartcontracts, etc.

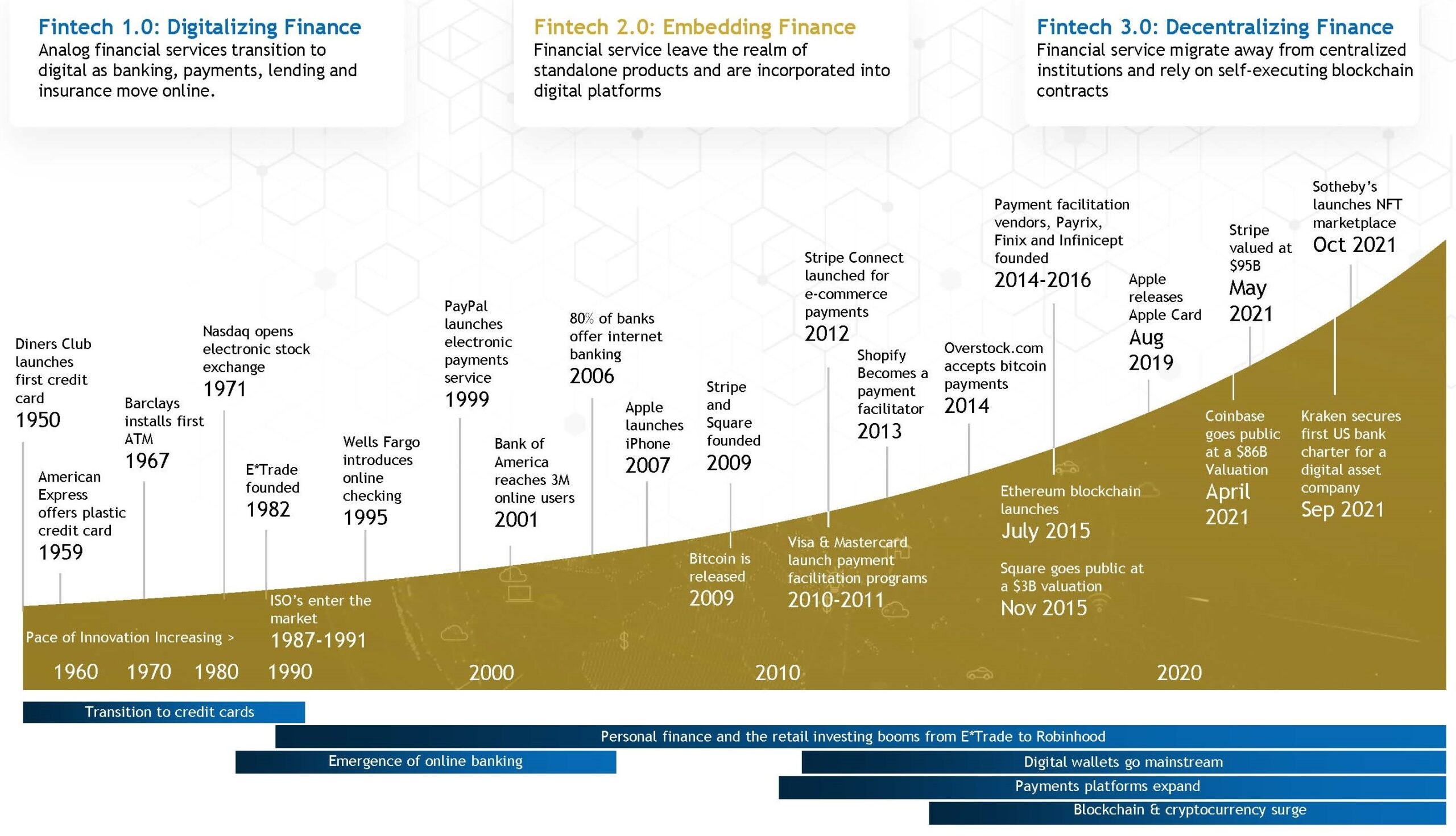

The Evolution of FinTech

The financial services industry is at a structural inflection point. We believe that the wave of unprecedented regulation and the proliferation of low-cost enabling technologies are providing the necessary catalysts for significant dislocation and democratization of market share.

The Fund seeks to source investments in secondary markets through Manager's proprietary network of intermediaries and in Fintech focused funds run by experienced and/ or emerging Fintech/ VC managers.

Investor commitment amount includes all signed investor subscriptions through 6/30/2023.